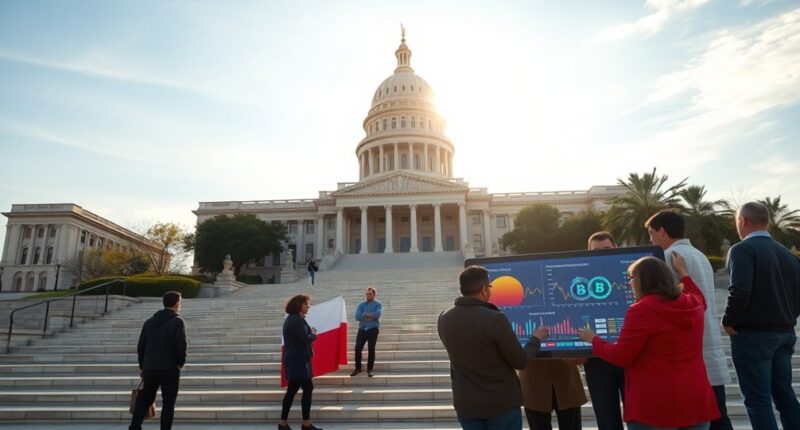

Texas is making headlines by considering the use of taxpayer dollars to invest in Bitcoin through Senate Bill 21. This move, aimed at diversifying state assets and hedging against inflation, positions Texas as a potential leader in cryptocurrency adoption. However, the decision raises important questions about the wisdom of investing public funds in such a volatile market. As the implications of this bold initiative unfold, you'll want to explore what this could mean for the state's financial future.

As Texas pushes forward with its innovative financial strategies, the state has introduced Senate Bill 21 (SB 21), which aims to establish a Bitcoin reserve. This bold move allows Texas to invest in cryptocurrencies, specifically targeting assets with a market capitalization of at least $500 billion. Currently, only Bitcoin meets this threshold, making it the sole candidate for the reserve.

By diversifying state financial assets, Texas hopes to hedge against inflation and solidify its position as a tech-friendly state. The legislation has garnered significant support, especially from Lieutenant Governor Dan Patrick, who prioritizes this initiative. The Texas Comptroller's Office will manage the reserve, overseeing the acquisition, sale, and management of these crypto holdings. Senate Bill 21 is expected to pass due to the Republican majority support in the legislature, further solidifying the state's commitment to this initiative.

Texas aims to hedge against inflation and enhance its tech-friendly reputation through strategic diversification of state financial assets.

Funding for the reserve will come from various sources, including legislative appropriations, dedicated revenue streams, private donations, and, of course, cryptocurrency holdings. Texas is committed to ensuring that these assets are secure, implementing strict measures like cold storage to prevent theft or loss. Deploying regulatory compliance is essential to navigating the complexities of digital asset management.

Investing in Bitcoin presents a potential hedge against inflation due to its decentralized nature and limited supply. In uncertain economic climates, this strategic move could enhance financial security for the state. Historical data shows Bitcoin's significant long-term appreciation, which aligns with Texas's goal of yielding substantial returns through strategic asset management.

However, it's essential to recognize the risks involved, including volatility and regulatory uncertainties that could impact the reserve's performance. Texas isn't just looking at the financial side of Bitcoin; it's also considering the technological implications.

The state has become a major hub for Bitcoin mining, thanks to its abundant energy resources. By strategically managing Bitcoin mining operations, Texas can contribute to grid stability by utilizing excess energy. This embrace of cryptocurrency could attract more blockchain and digital finance businesses, positioning the state as a leader in technological innovation.

While the potential benefits are enticing, Texas faces challenges in navigating the evolving regulatory landscape for cryptocurrencies. Clear guidelines are necessary to ensure compliance with federal regulations.

Additionally, robust security measures will be crucial in preventing any theft or loss of assets. Educating the public about Bitcoin will also play a vital role in shaping perceptions and understanding of this transformative financial strategy.