Bitcoin ETFs allow you to invest easily through traditional brokerage accounts without needing to manage digital wallets or navigate crypto exchanges. They offer familiarity and convenience, giving you exposure to Bitcoin’s price movements. However, they come with risks like high market volatility and potential regulatory changes that can impact performance. While they provide a regulated alternative, understanding both benefits and risks is key. If you want to explore more about how these factors influence your investment options, keep going.

Key Takeaways

- Bitcoin ETFs offer easy access and familiar investment methods without needing digital wallets or crypto exchanges.

- They provide exposure to Bitcoin’s price movements while avoiding direct handling of volatile digital assets.

- Market volatility can cause rapid price swings, increasing potential gains but also significant risks.

- Regulatory developments influence ETF availability, investor confidence, and overall market stability.

- Suitable mainly for high-risk investors with a long-term horizon who can tolerate short-term price fluctuations.

Have you ever wondered how investors can gain exposure to Bitcoin without directly owning the cryptocurrency? Bitcoin ETFs offer a straightforward way to do just that. Instead of managing digital wallets or steering through crypto exchanges, you can buy shares of a Bitcoin ETF through your regular brokerage account. These funds track the price of Bitcoin, giving you a way to invest in its potential upside without the complexities of handling the actual digital currency. This method appeals to those who want exposure to Bitcoin’s growth but prefer the familiarity and security of traditional investment vehicles.

However, investing in Bitcoin ETFs isn’t without its challenges. One key factor to think about is how cryptocurrency regulation impacts these products. Regulatory frameworks around cryptocurrencies are still evolving worldwide. Governments are working to establish rules that protect investors while trying not to stifle innovation. This ongoing uncertainty can influence how Bitcoin ETFs are managed and offered. For example, if regulations tighten, certain ETFs could face restrictions or increased compliance costs, potentially affecting their performance and liquidity. On the other hand, clearer regulations can also boost investor confidence, making Bitcoin ETFs a more mainstream investment option. It’s essential to stay informed about regulatory developments, as they can considerably impact your investment’s risk profile. Additionally, understanding the contrast ratio of the underlying assets can help assess the potential for gains during market surges.

Another critical aspect to reflect on is market volatility. Bitcoin is notorious for its sharp price swings over short periods. This volatility can be magnified in Bitcoin ETFs because they often hold Bitcoin directly or use derivatives to track its price. As a result, your investment can experience rapid and unpredictable changes in value, sometimes within a single trading day. While this volatility can create opportunities for significant gains, it also increases the risk of substantial losses. If you’re risk-averse or have a short-term investment horizon, Bitcoin ETFs might not suit your financial goals. Conversely, if you’re comfortable with high-risk, high-reward scenarios, these ETFs can provide a way to capitalize on Bitcoin’s price movements without the need for active trading or technical expertise.

DRAGON RIOT Professional Butcher Knife Set for Meat Processing, 3Pcs High Carbon Steel Hand Forged Serbian Cleaver Chef Knife Set with Ergonomic Handles for Kitchen Outdoor Cooking

【Professional Butcher Knife Set Multi-functional】 The DRAGON RIOT meticulously crafted Kitchen Knife Set includes: Serbian chef's knife,Cleaver knife,...

As an affiliate, we earn on qualifying purchases.

Frequently Asked Questions

How Do Bitcoin ETFS Impact Traditional Cryptocurrency Markets?

Bitcoin ETFs impact traditional cryptocurrency markets by increasing market liquidity, making it easier for you to buy and sell Bitcoin-related assets without directly holding the cryptocurrency. They also enhance price discovery, helping to reflect the true market value of Bitcoin more accurately. As ETFs attract traditional investors, they can stabilize prices and reduce volatility, ultimately integrating cryptocurrencies into mainstream financial systems and influencing overall market dynamics.

Are Bitcoin ETFS Suitable for Passive or Active Investors?

You’ll find Bitcoin ETFs are perfect for passive investors enthusiastic to ride the wild waves of market volatility without the stress of daily trading. They simplify investment strategies, making it feel like you’re surfing a giant crypto tidal wave with ease. Active investors might find them too predictable, but if you want a hands-off approach that captures the crypto market’s pulse, Bitcoin ETFs are your ultimate tool.

What Are the Tax Implications of Investing in Bitcoin ETFS?

When you invest in Bitcoin ETFs, you’ll need to contemplate tax reporting requirements, which can vary by jurisdiction. You may owe taxes on capital gains when you sell or redeem shares, especially if their value increases. Keep track of your transactions for accurate reporting. Understanding these implications helps you plan better, ensuring you comply with tax laws and avoid surprises during tax season.

How Do Bitcoin ETFS Compare to Directly Holding Bitcoin?

When comparing Bitcoin ETFs to directly holding bitcoin, you get simplicity, regulation, and ease of trading versus the need for secure storage, constant monitoring, and exposure to security risks. With ETFs, your investment is managed by professionals, reducing storage concerns, but it might limit control. Holding bitcoin directly offers full ownership and control, yet demands careful storage options and exposes you to security risks like hacking.

What Are the Potential Regulatory Changes Affecting Bitcoin ETFS?

You should stay alert to potential regulatory changes that could impact Bitcoin ETFs, as authorities may impose new rules addressing regulatory hurdles and compliance challenges. These changes could involve stricter oversight, reporting requirements, or approval processes, possibly affecting your investment options and liquidity. By keeping informed, you can better navigate these evolving regulations, ensuring your investments remain compliant and aligned with the latest legal standards.

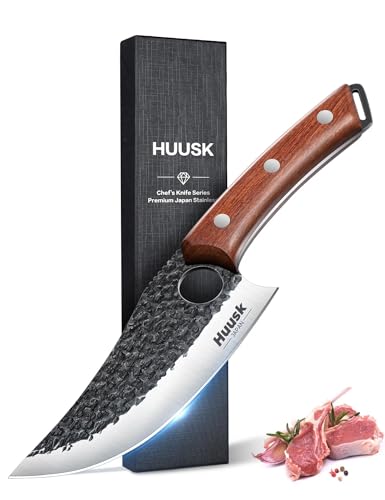

Huusk Viking Knife, Japanese Butcher Knife for Meat Cutting, Hand Forged Boning Knives with Ergonomic Wood Handle, High Carbon Steel Japanese Chef Knifes for Camping, BBQ, Knives for Men's Gifts

Handle length 5.12 inches, blade length 5.9 inches, overall knife length 11 inches

As an affiliate, we earn on qualifying purchases.

Conclusion

As you consider investing in Bitcoin ETFs, remember they offer exciting opportunities but come with hidden risks. The landscape is constantly evolving, and what seems like a safe bet today might change tomorrow. Will regulation tighten? Will market volatility spike unexpectedly? Stay vigilant, do your research, and be prepared for the surprises that could reshape your investment journey. The future of Bitcoin ETFs remains uncertain—are you ready to navigate the unknown?

Rondauno Brisket Knife, Carving Knife for Meat with 12 Inch Ultra Sharp Slicing Knives for Cutting BBQ, Turkey and Roast, Premium High Carbon Stainless Steel

Ultra Sharp Blade: Our carving knife for meat features a 12-inch blade to deliver highly precise cuts with...

As an affiliate, we earn on qualifying purchases.

Professional Meat Cleaver Knife, 7 Inch Butcher Knife, Heavy Duty Bone Chopper, Ultra Sharp High Carbon Steel Blade, Ergonomic Non-Slip Handle for Bone Cutting, Vegetable Chopping, Restaurant, Kitchen

All-in-One Kitchen Workhorse: "One knife rules them all!" From slicing steak to dicing veggies, the 0.1" thick blade...

As an affiliate, we earn on qualifying purchases.