Florida lawmakers are making a bold move by proposing to integrate Bitcoin into state reserves by 2025. This could set a precedent for other states like Utah and Illinois, which are also exploring similar initiatives. As more states observe these developments, the question arises: could this trend reshape public finance? Understanding the implications of such a shift might reveal surprising opportunities and challenges ahead.

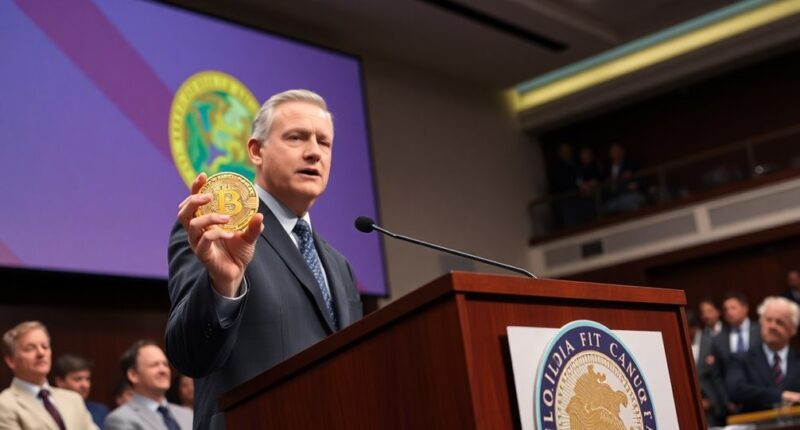

As states explore innovative ways to bolster their financial stability, Bitcoin has emerged as a compelling option for state reserves. In recent months, several states have taken significant steps toward integrating Bitcoin into their financial frameworks. Florida, for instance, is actively discussing plans to include Bitcoin in its state reserves by 2025, potentially utilizing its pension fund. This reflects a growing trend where lawmakers are recognizing Bitcoin's potential as a valuable asset.

You might wonder how Florida's initiative compares to other states. Utah has already made strides with a Bitcoin reserve bill that allows state treasurers to allocate up to 5% of public funds to Bitcoin. Illinois is also in the game with House Bill 1844, proposing a strategic Bitcoin reserve that would require a mandatory five-year holding period. Arizona has jumped on board, too, allowing public funds and pensions to invest in Bitcoin, which has garnered bipartisan support. Additionally, both Illinois and Arizona represent significant advancements in the push for structured Bitcoin reserve plans.

Texas has introduced a unique approach, enabling residents to donate Bitcoin to state reserves, showcasing the community's interest in this digital currency. Meanwhile, Pennsylvania is looking to take it a step further by potentially allocating up to 10% of its public funds to Bitcoin. These initiatives indicate a strong interest in diversifying state reserves with this cryptocurrency.

As you consider the broader picture, it's clear that states like Florida, Utah, and Illinois are setting a precedent that could influence others. Alabama, Montana, South Dakota, and Kentucky have all expressed interest in Bitcoin reserves, although they haven't yet formalized legislation. This creates a landscape where states are closely watching each other, possibly waiting for a successful implementation before making their own moves.

On a federal level, discussions are also heating up. Senator Cynthia Lummis has proposed a national Bitcoin reserve, aiming to accumulate 1 million BTC over five years. This could spark a wave of regulatory changes, clarifying how cryptocurrencies like Bitcoin are categorized and managed. The Commodity Futures Trading Commission (CFTC) may play a crucial role in overseeing these assets, ensuring they fit within a structured regulatory framework.

With global examples like El Salvador adopting Bitcoin as part of its national reserves, the question remains: will Florida's efforts inspire other states to follow suit? As more lawmakers recognize Bitcoin's potential, the landscape for state reserves may soon look quite different.