Cantor Fitzgerald's recent Overweight rating for Planet Labs, along with a price target of $6.30, suggests promising growth ahead. With a notable 42.41% increase in stock value this year and strong revenue guidance, it seems the company is poised for success. Their strategic contracts and technological advancements are worth considering, but what does this mean for your investment strategy? The implications could be significant.

Cantor Fitzgerald has kicked off coverage of Planet Labs with an Overweight rating, setting a price target of $6.30. This news is significant because it reflects a strong belief in Planet Labs' potential and growth trajectory. Since the start of the year, you may have noticed Planet Labs' stock has surged by 42.41%, indicating that investors are taking notice of the company's prospects. With this new rating, analysts suggest the stock has room to grow, offering you a compelling investment opportunity.

One of the key factors behind this Overweight rating is Planet Labs' recent advancements and partnerships. The company was selected as a vendor for a $200 million geospatial data contract, which signals strong demand for its services. Additionally, you might be interested to know that Planet Labs has expanded its contract with Colombia's National Police, enhancing its footprint in the geospatial sector. Such contracts not only validate Planet Labs' offerings but also contribute to a strong revenue outlook.

Speaking of revenue, Planet Labs reported $61.3 million in the third quarter, slightly below expectations, but there's a silver lining. The firm has made strides in narrowing its non-GAAP losses, showcasing improved financial performance. The third quarter marked the strongest bookings period for the company, indicating robust client interest and demand for its services. Moreover, the 23% revenue growth reported by a comparable company, Meta, highlights the potential for similar growth trajectories among innovative firms in the tech sector.

As you look at the fourth quarter, Planet Labs has provided optimistic revenue guidance, further solidifying its growth narrative.

Technological advancements are also at the forefront of Planet Labs' strategy. The launch of its high-resolution Pelican-2 satellite, along with additional SuperDoves, enhances its data collection capabilities. These satellites are crucial for delivering analysis-ready products that cater to time-series analysis and machine learning models. As an investor, you'll want to keep an eye on how these technological milestones can drive future growth.

Moreover, Planet Labs has forged partnerships to amplify its offerings. Its collaboration with Laconic aims to deliver AI-powered forest carbon insights, which is a growing area of interest given the increasing focus on sustainability. The partnership with Abelio to develop precision farming tools also highlights Planet Labs' commitment to innovation in agricultural technology. These partnerships not only diversify its revenue streams but also enhance its competitive positioning in the market.

Despite some fluctuations in the stock, the overall trend remains positive, reflecting investor confidence. The combination of recent contracts, technological innovations, and strategic partnerships positions Planet Labs well for the future.

With Cantor Fitzgerald's Overweight rating and a price target of $6.30, you might find that now is an opportune moment to consider investing in Planet Labs. The company's trajectory suggests it could continue to deliver value to its shareholders, aligning with your investment goals.

3 Pack Heavy Duty Bamboo Cutting Board Set Non Toxic Wooden Cutting Board for Kitchen Non Slip Solid End Grain Thick Wood Juice Groove Chopping Board Extra Large Butcher Block Best House Warming Gift

Non-Slip Design and Exceptional Craftsmanship: Our FSC-certificated bamboo cutting board set for kitchen are designed with a superior...

As an affiliate, we earn on qualifying purchases.

Amazon Product B0FHW3MNKN

As an affiliate, we earn on qualifying purchases.

Keechee Wood Cutting Board, Carbonized Bamboo Cutting Boards Set With Smooth Surface & Easy Storage For Busy Kitchens, Ideal Charcuterie & Chopping, Durable, Knife-Friendly (4Pcs)

BAMBOO CUTTING BOARD of 4 - Keechee offers a versatile set with sizes including 18x12inches, 15x10 inches, 12x8...

As an affiliate, we earn on qualifying purchases.

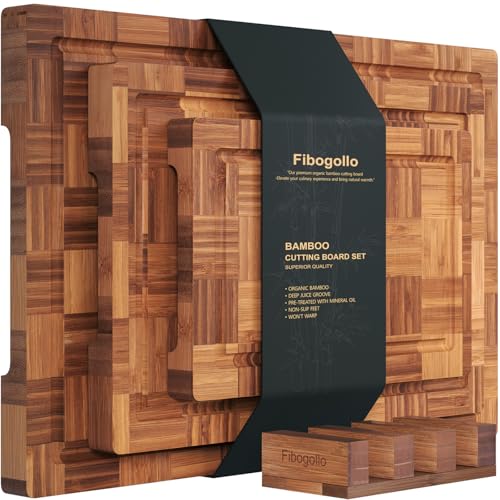

Fibogollo Bamboo Cutting Boards for Kitchen,Chopping Boards Set with Juice Groove,End Grain Bamboo Butcher Block,Serving Board with Holder(3 Pcs)

【Splicing Craft,Innovative Design】This chopping board features a bamboo unique splicing craft design, crafted with a fine attention to...

As an affiliate, we earn on qualifying purchases.