You might notice that January's Bitcoin mining revenue fell short of December's by $40 million, averaging daily earnings of $48.16 million. While this decline raises questions, it's intriguing to see a 26.91% year-over-year increase. Daily fluctuations suggest a consistent performance despite market challenges. What's driving this resilience, and how do factors like block rewards and transaction fees influence the mining landscape?

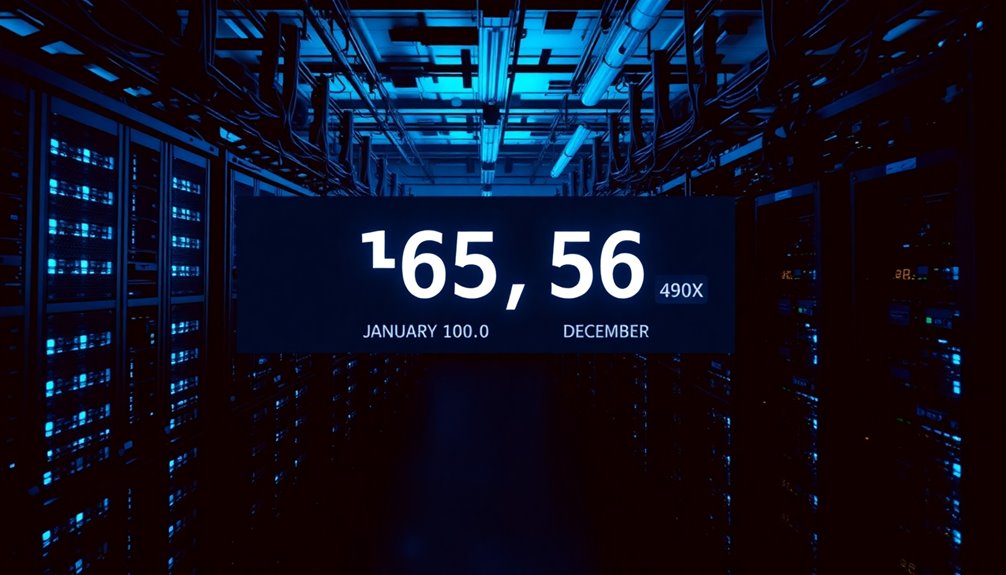

What drives the fluctuating fortunes of Bitcoin miners today? In January 2025, Bitcoin miners generated around $48.16 million a day, showing a notable 26.91% increase from the previous year's revenue of $37.95 million. This consistent growth is a silver lining in the otherwise volatile world of cryptocurrency. However, January's figures still trail December's revenue by a stark $40 million, reflecting the ups and downs that miners often face. Notably, on January 31, 2025, Bitcoin miners' revenue per day dropped to $41.22 million, indicating a significant decrease from the previous day.

Daily revenue isn't static; it fluctuates significantly, ranging from $40.56 million to $52.23 million throughout January. These variations stem from multiple factors, including the balance of block rewards and transaction fees. As a miner, you know that both elements are crucial for maximizing your earnings. The historical trend indicates that while revenue generally rises over time, market conditions can trigger occasional dips.

Profitability remains a pressing concern for miners. Over the years, you've likely noticed that profitability can spike, particularly during market booms, like the surge at the end of 2020. The hash rate plays a major role in your potential earnings; a higher hash rate typically means higher rewards. But don't forget about costs—energy expenses and the efficiency of your hardware are critical factors that can eat into your profits. Market volatility directly impacts mining profitability, so when Bitcoin prices rise, your potential earnings can significantly increase.

Additionally, external elements such as regulatory changes and technological advancements can sway the mining landscape. You might find that innovations in mining technology help you reduce energy consumption and improve efficiency, making it easier to stay competitive. However, the regulatory environment can also introduce uncertainty, which might challenge your operations and revenue stability.

Looking ahead, sustainability concerns and energy consumption will continue to be pivotal issues for the mining industry. As you navigate these challenges, technological innovations will likely enhance efficiency and reduce costs. Yet, market volatility remains a constant factor influencing your revenue and profitability. The competition among miners can also lead to consolidation, which may alter how revenue gets distributed across the industry.

In this ever-evolving landscape, staying informed and adaptable is your best strategy. Understanding these dynamics will help you better manage your mining operations and navigate the complexities of Bitcoin revenue generation.