China's recent sentencing of a former regulator to 11 years in prison for his role in a Bitcoin scandal raises serious questions about the future of cryptocurrency in the country. It's a clear message that the government isn't tolerating corruption within the crypto space. As the crackdown intensifies, you might wonder how this will impact other players in the industry and what it means for the broader regulatory landscape.

As China cracks down on crypto-related corruption, a former party official has been sentenced to life in prison for his involvement in a Bitcoin scandal. This case is just one example of the strict regulatory environment that has emerged since China banned all crypto transactions on the mainland in September 2021. The government's crackdown on crypto activities isn't new; prior to the ban, they'd already begun restricting crypto mining in certain provinces as early as May 2021.

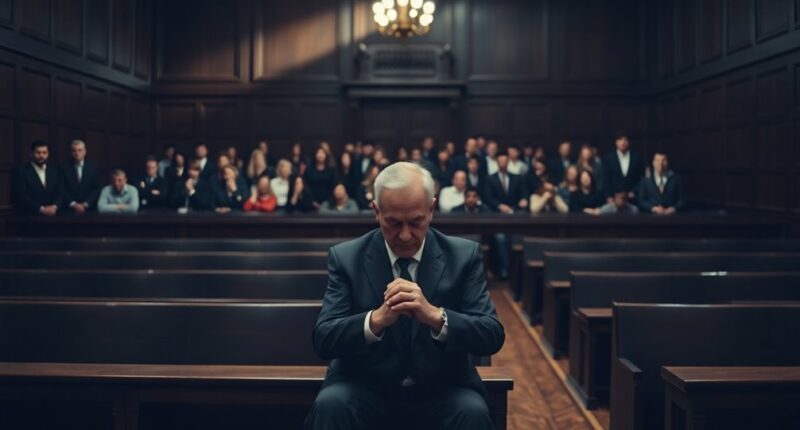

Now, with severe penalties for violations, authorities are sending a clear message: they won't tolerate corruption in the crypto space. The former party official was found guilty of abusing his power to facilitate illegal crypto mining operations while accepting bribes. His life sentence, which also included deprivation of political rights and confiscation of personal property, highlights the government's aggressive stance toward anyone involved in crypto corruption. The high prevalence of fraud in the cryptocurrency sector has further fueled the government's resolve to enforce strict regulations.

You can see how these legal actions play a significant role in China's broader efforts to control and regulate crypto activities. This is crucial for maintaining the government's grip on the financial landscape. Even with these stringent regulations, the global crypto market remains surprisingly resilient. While the ban on crypto transactions in China might seem like it would shake the market, it hasn't had a lasting impact.

Other scandals and bankruptcies have popped up in the crypto world, but they've also failed to create significant disruptions. The global crypto community keeps a close eye on China's regulatory actions, as they often set precedents for how other countries might respond. Yet, it appears that the market dynamics can sometimes operate independently of these regulations.

China's approach to crypto regulation stands out, emphasizing control and prohibition rather than fostering innovation. The lack of clear regulations in some regions leads to confusion and, unfortunately, illegal activities. As the government pushes for tighter controls, you can expect future directions to involve more stringent enforcement of existing laws.

International cooperation may also become essential in shaping global crypto regulations, especially as countries navigate their own regulatory challenges. In the end, the sentencing of this former party official serves as a stark reminder of China's uncompromising stance on crypto-related corruption. As the landscape continues to evolve, it'll be interesting to see how these regulatory efforts impact the broader crypto market moving forward.